Pension for life new policies are out - check them out!!

+20

Teager

daverobitaille@rogers.com

Crockett

Iceman

MikeCeeGB

Rubicon

Gunner8

Nemo

czerv

umbrella001

Zodiac

bosn181

XMedic

Rifleman

Whodunit

propat

By the Bay

johnny211

bigrex

cosmo12

24 posters

Page 1 of 9

Page 1 of 9 • 1, 2, 3, 4, 5, 6, 7, 8, 9

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

no, that makes sense, it was only called PF L because Trudeau used that tag line to gain the veteran vote, “ chicken feed “ wouldn’t go over so well, lolCrockett wrote:Here is my take on it. It may be a benefit if you are younger and the monthly amount is more than 500.00 because over the long haul it would add up to significantly more money(and although 500.00 dollars doesn't go far it may pay some monthly bills). In my case it was a mere 115.00 dollars per month which would only result in more money for me after the age of 75. Not to mention 115.00 per month does absolutely nothing for me as far as living expenses...it's certainly not pension for life. So in a nutshell the new "Pension for life" only benefits younger more severely injured vets and even then it would still have to be supplemented with other benefits. But you know, if I live to 100, it would double the amount I received over my lifetime. As far as I'm concerned it should have never been called "Pension for life" They should have been upfront and just said you have the option to take the money over your lifetime if you so choose. It certainly would have made the transition in April much easier for Vets and for VAC.

As far as your question on advantages and disadvantages, At this point, I think it's more of a personal choice based on your age and the amount rewarded. I wish I could give a more concrete answer but it is different for everyone.

Unknown Soldier- CSAT Member

- Number of posts : 621

Location : MIR

Registration date : 2019-05-15

advantages and disadvantages of lump sum

advantages and disadvantages of lump sum

Here is my take on it. It may be a benefit if you are younger and the monthly amount is more than 500.00 because over the long haul it would add up to significantly more money(and although 500.00 dollars doesn't go far it may pay some monthly bills). In my case it was a mere 115.00 dollars per month which would only result in more money for me after the age of 75. Not to mention 115.00 per month does absolutely nothing for me as far as living expenses...it's certainly not pension for life. So in a nutshell the new "Pension for life" only benefits younger more severely injured vets and even then it would still have to be supplemented with other benefits. But you know, if I live to 100, it would double the amount I received over my lifetime. As far as I'm concerned it should have never been called "Pension for life" They should have been upfront and just said you have the option to take the money over your lifetime if you so choose. It certainly would have made the transition in April much easier for Vets and for VAC.

As far as your question on advantages and disadvantages, At this point, I think it's more of a personal choice based on your age and the amount rewarded. I wish I could give a more concrete answer but it is different for everyone.

As far as your question on advantages and disadvantages, At this point, I think it's more of a personal choice based on your age and the amount rewarded. I wish I could give a more concrete answer but it is different for everyone.

Crockett- CSAT Member

- Number of posts : 26

Location : Maitland Bridge

Registration date : 2019-04-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

so are you opting for a monthly payment, what are the advantages/ disadvantages of taking a lump sum.? Thanks.Crockett wrote:As far as I know a medical pension falls under the same realm as retirement income,

Can retirement income be garnished?

Neither the Ontario Pension Benefits Act or the Canada Pension Plan Act make any reference to garnishments.

That means that a typical creditor cannot garnishee your retirement pension or Old Age Security (OAS) including the Guaranteed Income Supplement, the Allowance, and the Allowance for the Survivor.

However, there are five exceptions or cases where you could lose some or all of your government pension:

Pension funds you deposit into a bank account where you owe money. Banks can seize money in your account if you owe them money. This is called the right of ‘set off’. They can take any amount out of your account, up to the balance owing.

Child or Spousal support arrears. The Family Responsibility Office can be granted a garnishment of pension income to recover arrears for child or spouse support and can garnish up to 50% of your pension.

Canada Revenue Agency (CRA) has broad garnishment powers. No court order is required for them to garnish your pension. They can simply send a letter to your bank or the Income Security Program office (the government office responsible for CPP and OAS).

Income Security Overpayments. If you were overpaid (perhaps on OAS where your income increased), the government can deduct overpayments from future benefits until the entire amount is repaid.

Social Assistance Repayments. If you are eligible for OAS you are generally not eligible for Ontario Works or ODSP, but if you are over paid, the overpayment can be clawed back from your pension.

This has been in place for quite some time, so I'm not sure if it was an oversight on VAC's part and they added it to the form, or if the PSC now falls under a new realm that is unprotected. I think you could argue the point if your payment was garnished for anything other than the above, however, it might take a lawyer and lots of money to win a case.

I'm surprised they only deducted the exact amount you received from the total PSC, with all these new calculations to make that 54.00 last for life...lol

And now you got me thinking, how do they determine how long your life will be...I'm not sure if they are doing what they say they are. For instance, In my case I was awarded 115.00 per month, which is 1380.00 per year. Multiply that by 25 years and that gives me 34,500..so close to the actual amount...and that is without this so called interest they add to make it go further. Seriously are they basing it on a lifespan of 50 years...that would make me 102 years old, although not impossible, I highly doubt I'm living that long.

Unknown Soldier- CSAT Member

- Number of posts : 621

Location : MIR

Registration date : 2019-05-15

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

Wow! They really do just throw out a random number. I remember sending messages asking for updates and they would say they were working on claims from (insert month here) and they would regularly name a month that was earlier than what they stated previously.

This is so insulting.

This is so insulting.

MikeCeeGB- CSAT Member

- Number of posts : 32

Location : Nova Scotia

Registration date : 2018-11-30

Lump sum payouts

Lump sum payouts

So, I received my letter for lump sum payment and sent it back the same day. I contacted Vac to find out a timeline for payment.

First response "Thank you for using My VAC Account and our secure email services.

I advised in your previous email that I can see that you uploaded

a document on May 13, 2019 and the document was sent to our scanning

department. If that document

is the Election form, please let us know so we can have the document

pulled from the queue to be scanned quicker and sent to the appropriate

unit (Head Office).

The turn around time is approximately 6 business days once the

form has been received at Head Office. It takes Head Office

2 business days to send the requisition to the payment department,

it take 2 business days for the payment department to issue the

payment to the bank and it can take the bank up to 2 business

days to deposit the payment into your bank account.

The Government of Canada recognizes the contributions and sacrifices

of Veterans. Thank you for your service and we encourage you

to continue to make your needs known to the Department.

If you have any further questions or concerns, please contact

us again via My VAC Account or our toll-free number, 1-866-522-2122."

Second response;

"Thank you for using My VAC Account and our secure email service.

Thank you. Your form has been forwarded to the pay unit for

processing. The turnaround time is approximately 10 business

days. Thank you very much for your patience.

If you have any further questions or concerns, please contact

us again via My VAC Account or our toll-free number 1-866-522-2122."

Third response;

"Thank you for using My VAC Account and our secure email service.

In response to your email message of May 30th, 2019, I can confirm

with you that we have received the form VAC2521 on May 13th,

2019. Please note that the turnaround time for this request is

approximately 4 weeks. Thank you for your patience.

The Government of Canada recognizes the contributions and sacrifices

of Veterans. Thank you for service and we encourage you to continue

to make your needs known to the Department.

If you have any further questions or concerns, please contact

us again via My VAC Account, or at our toll free number 1-866-522-2122."

Funny how the timeline just keeps getting longer and longer.

First response "Thank you for using My VAC Account and our secure email services.

I advised in your previous email that I can see that you uploaded

a document on May 13, 2019 and the document was sent to our scanning

department. If that document

is the Election form, please let us know so we can have the document

pulled from the queue to be scanned quicker and sent to the appropriate

unit (Head Office).

The turn around time is approximately 6 business days once the

form has been received at Head Office. It takes Head Office

2 business days to send the requisition to the payment department,

it take 2 business days for the payment department to issue the

payment to the bank and it can take the bank up to 2 business

days to deposit the payment into your bank account.

The Government of Canada recognizes the contributions and sacrifices

of Veterans. Thank you for your service and we encourage you

to continue to make your needs known to the Department.

If you have any further questions or concerns, please contact

us again via My VAC Account or our toll-free number, 1-866-522-2122."

Second response;

"Thank you for using My VAC Account and our secure email service.

Thank you. Your form has been forwarded to the pay unit for

processing. The turnaround time is approximately 10 business

days. Thank you very much for your patience.

If you have any further questions or concerns, please contact

us again via My VAC Account or our toll-free number 1-866-522-2122."

Third response;

"Thank you for using My VAC Account and our secure email service.

In response to your email message of May 30th, 2019, I can confirm

with you that we have received the form VAC2521 on May 13th,

2019. Please note that the turnaround time for this request is

approximately 4 weeks. Thank you for your patience.

The Government of Canada recognizes the contributions and sacrifices

of Veterans. Thank you for service and we encourage you to continue

to make your needs known to the Department.

If you have any further questions or concerns, please contact

us again via My VAC Account, or at our toll free number 1-866-522-2122."

Funny how the timeline just keeps getting longer and longer.

Crockett- CSAT Member

- Number of posts : 26

Location : Maitland Bridge

Registration date : 2019-04-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

From the Pension Act

"Awards not to be assigned or charged

From the VWBA

"Not to be assigned or charged

So, only retroactive monthly payments could be reduced, IF there had been payments from other government agencies during that time, but they couldn't reduce future payments. And as far as Child support, they cannot automatically deduct money from a disability pension, but the pension you recieve, is to be used to determine your overall income, when calculating the amount of child support payments. This was litigated during the SISIP lawsuit, because the child support exemption, was the only example the GoC lawyers could find where the disability pension was allowed to be considered as income.

"Awards not to be assigned or charged

- 30 (1) No award shall be assigned, charged, attached, anticipated, commuted or given as security, and the Minister may refuse to recognize any power of attorney granted by a person with reference to the payment of an award.

- Marginal note:Exemption from seizure and execution

(1.1) An award is exempt from seizure and execution, either at law or in equity. - Marginal note:Exception

(2) Notwithstanding subsection (1), where any provincial or municipal authority in a province pays a person any advance, assistance or welfare payment for a period that would not be paid if a pension or an allowance under this Act had been paid for that period and subsequently a pension or an allowance becomes payable or payment of a pension or an allowance may be made under this Act to that person for that period, the Minister may deduct from any retroactive payment of pension or allowance and pay to the government of the province an amount not exceeding the amount of the advance, assistance or welfare payment paid, if that person had, on or before receiving the advance, assistance or welfare payment from the government of the province or the municipal authority, consented in writing to the deduction and payment."

From the VWBA

"Not to be assigned or charged

- 89 (1) No compensation payable under this Act shall be assigned, charged, attached, anticipated, commuted or given as security."

So, only retroactive monthly payments could be reduced, IF there had been payments from other government agencies during that time, but they couldn't reduce future payments. And as far as Child support, they cannot automatically deduct money from a disability pension, but the pension you recieve, is to be used to determine your overall income, when calculating the amount of child support payments. This was litigated during the SISIP lawsuit, because the child support exemption, was the only example the GoC lawyers could find where the disability pension was allowed to be considered as income.

bigrex- CSAT Member

- Number of posts : 4064

Location : Halifax, Nova Scotia

Registration date : 2008-09-18

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

As far as I know a medical pension falls under the same realm as retirement income,

Can retirement income be garnished?

Neither the Ontario Pension Benefits Act or the Canada Pension Plan Act make any reference to garnishments.

That means that a typical creditor cannot garnishee your retirement pension or Old Age Security (OAS) including the Guaranteed Income Supplement, the Allowance, and the Allowance for the Survivor.

However, there are five exceptions or cases where you could lose some or all of your government pension:

Pension funds you deposit into a bank account where you owe money. Banks can seize money in your account if you owe them money. This is called the right of ‘set off’. They can take any amount out of your account, up to the balance owing.

Child or Spousal support arrears. The Family Responsibility Office can be granted a garnishment of pension income to recover arrears for child or spouse support and can garnish up to 50% of your pension.

Canada Revenue Agency (CRA) has broad garnishment powers. No court order is required for them to garnish your pension. They can simply send a letter to your bank or the Income Security Program office (the government office responsible for CPP and OAS).

Income Security Overpayments. If you were overpaid (perhaps on OAS where your income increased), the government can deduct overpayments from future benefits until the entire amount is repaid.

Social Assistance Repayments. If you are eligible for OAS you are generally not eligible for Ontario Works or ODSP, but if you are over paid, the overpayment can be clawed back from your pension.

This has been in place for quite some time, so I'm not sure if it was an oversight on VAC's part and they added it to the form, or if the PSC now falls under a new realm that is unprotected. I think you could argue the point if your payment was garnished for anything other than the above, however, it might take a lawyer and lots of money to win a case.

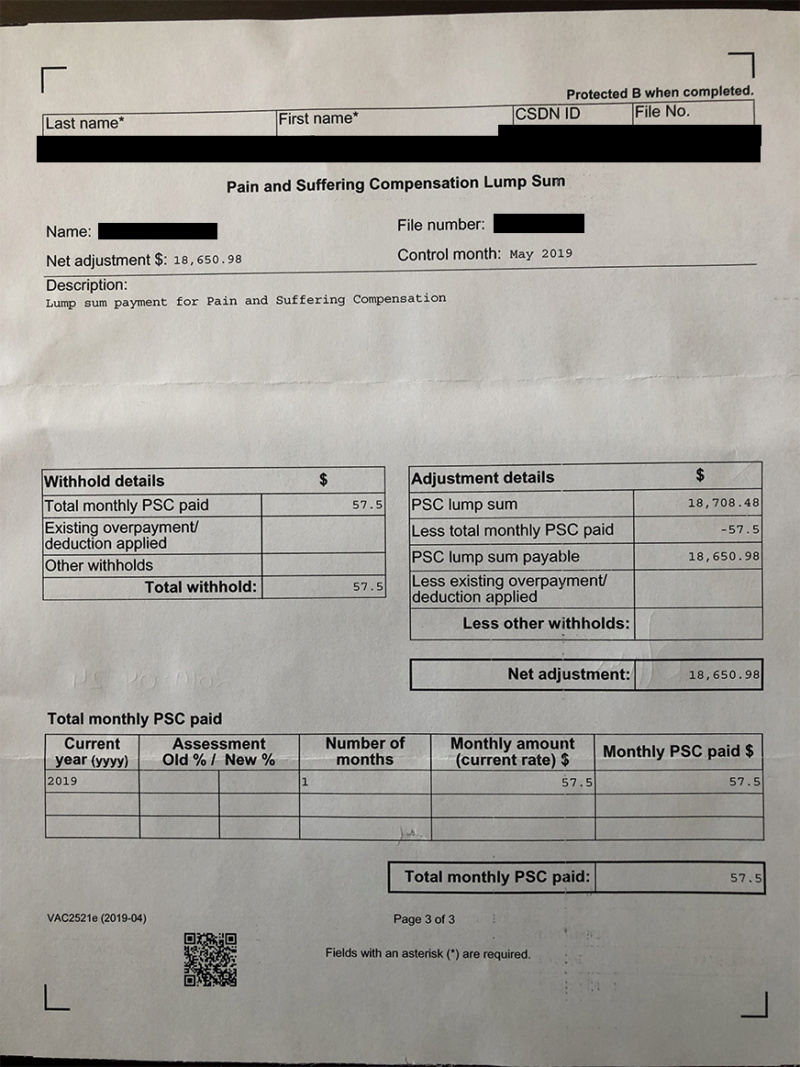

I'm surprised they only deducted the exact amount you received from the total PSC, with all these new calculations to make that 54.00 last for life...lol

And now you got me thinking, how do they determine how long your life will be...I'm not sure if they are doing what they say they are. For instance, In my case I was awarded 115.00 per month, which is 1380.00 per year. Multiply that by 25 years and that gives me 34,500..so close to the actual amount...and that is without this so called interest they add to make it go further. Seriously are they basing it on a lifespan of 50 years...that would make me 102 years old, although not impossible, I highly doubt I'm living that long.

Can retirement income be garnished?

Neither the Ontario Pension Benefits Act or the Canada Pension Plan Act make any reference to garnishments.

That means that a typical creditor cannot garnishee your retirement pension or Old Age Security (OAS) including the Guaranteed Income Supplement, the Allowance, and the Allowance for the Survivor.

However, there are five exceptions or cases where you could lose some or all of your government pension:

Pension funds you deposit into a bank account where you owe money. Banks can seize money in your account if you owe them money. This is called the right of ‘set off’. They can take any amount out of your account, up to the balance owing.

Child or Spousal support arrears. The Family Responsibility Office can be granted a garnishment of pension income to recover arrears for child or spouse support and can garnish up to 50% of your pension.

Canada Revenue Agency (CRA) has broad garnishment powers. No court order is required for them to garnish your pension. They can simply send a letter to your bank or the Income Security Program office (the government office responsible for CPP and OAS).

Income Security Overpayments. If you were overpaid (perhaps on OAS where your income increased), the government can deduct overpayments from future benefits until the entire amount is repaid.

Social Assistance Repayments. If you are eligible for OAS you are generally not eligible for Ontario Works or ODSP, but if you are over paid, the overpayment can be clawed back from your pension.

This has been in place for quite some time, so I'm not sure if it was an oversight on VAC's part and they added it to the form, or if the PSC now falls under a new realm that is unprotected. I think you could argue the point if your payment was garnished for anything other than the above, however, it might take a lawyer and lots of money to win a case.

I'm surprised they only deducted the exact amount you received from the total PSC, with all these new calculations to make that 54.00 last for life...lol

And now you got me thinking, how do they determine how long your life will be...I'm not sure if they are doing what they say they are. For instance, In my case I was awarded 115.00 per month, which is 1380.00 per year. Multiply that by 25 years and that gives me 34,500..so close to the actual amount...and that is without this so called interest they add to make it go further. Seriously are they basing it on a lifespan of 50 years...that would make me 102 years old, although not impossible, I highly doubt I'm living that long.

Crockett- CSAT Member

- Number of posts : 26

Location : Maitland Bridge

Registration date : 2019-04-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

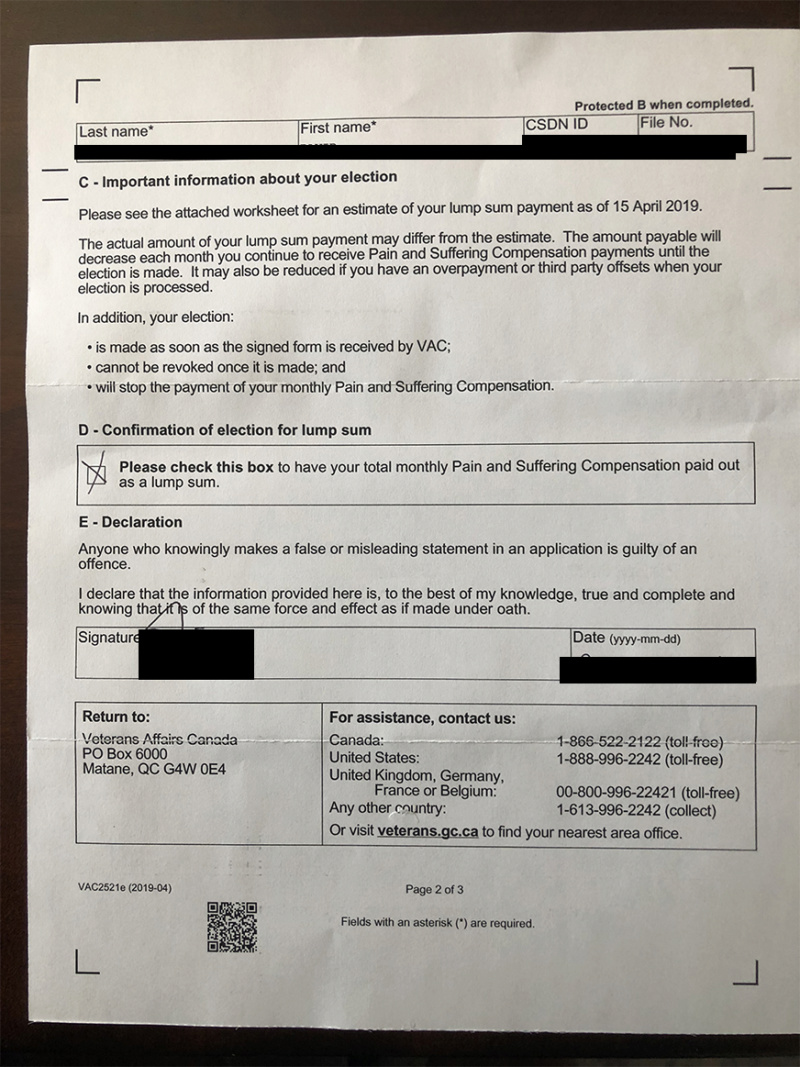

What caught my eye, was the last line in the first paragraph.

"It may also be reduced, if you have an overpayment or third party offsets when your selection is processed"

Since until now, the disability pension/award could not be reduced because of other income, seized or garnished to pay off debts, this line seems out of place, unless they have removed those protections.

"It may also be reduced, if you have an overpayment or third party offsets when your selection is processed"

Since until now, the disability pension/award could not be reduced because of other income, seized or garnished to pay off debts, this line seems out of place, unless they have removed those protections.

bigrex- CSAT Member

- Number of posts : 4064

Location : Halifax, Nova Scotia

Registration date : 2008-09-18

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

Crockett wrote:Armygunner, did you receive the paperwork for your LS yet? This is such a stall tactic on their part...the form used to come with the award, now you have to wait for the forms, fill them in and send them requesting the LS. Another waste of time on their part because honestly I can't see anyone wanting to leave a 5% award as a monthly payment.

Yes, I did, took little over a week to receive the paperwork. Here are the 3 pages you will receive.

Armygunner- CSAT Member

- Number of posts : 77

Location : Canada

Registration date : 2016-09-04

Lump sum payments.

Lump sum payments.

Just as a side note for everyone. If you elect a lump sum, be advised that every payment made to you while you wait will reduce the lump sum. Now that it is pension for life, the amount reduced from the lump sum payment will be the monthly amount plus the accrued interest on it over the life time of the award. For instance if my award is 18,000 and I receive 100.00 dollars in my account, the payout will be 18.000 less 100.00 less whatever the amount is for accrued interest. I suspect there will be a huge stall tactic used in sending out the paperwork to request a lump sum, the longer it takes the more it benefits to the gov't.

Crockett- CSAT Member

- Number of posts : 26

Location : Maitland Bridge

Registration date : 2019-04-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

Got my VAC deposits today.

Teager- CSAT Member

- Number of posts : 193

Location : ON

Registration date : 2016-03-30

Paperwork for Lump sum payment

Paperwork for Lump sum payment

Armygunner, did you receive the paperwork for your LS yet? This is such a stall tactic on their part...the form used to come with the award, now you have to wait for the forms, fill them in and send them requesting the LS. Another waste of time on their part because honestly I can't see anyone wanting to leave a 5% award as a monthly payment.

Crockett- CSAT Member

- Number of posts : 26

Location : Maitland Bridge

Registration date : 2019-04-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

You know what ?

The reality of all of this GoC/VaC crap, is what we're really going to see this next Monday the 29th April when deposits are made.

Perhaps then we can approach their ... selective bureacratic fracked up clamshell mathematics.

I've dealt with them ever since around !986-87 PA.. It used to be pretty much straight up then.

Hey Crockett ... I understand your frustration. This site has a lot of info though.

That said, get support inside and out of it . . . savvy?

Stay very well all.

The reality of all of this GoC/VaC crap, is what we're really going to see this next Monday the 29th April when deposits are made.

Perhaps then we can approach their ... selective bureacratic fracked up clamshell mathematics.

I've dealt with them ever since around !986-87 PA.. It used to be pretty much straight up then.

Hey Crockett ... I understand your frustration. This site has a lot of info though.

That said, get support inside and out of it . . . savvy?

Stay very well all.

pinger- CSAT Member

- Number of posts : 1270

Location : Facebook-less

Registration date : 2014-03-04

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

PFL is alive and kicking, just seen a deduction will update tonight could be everything they gave me, carbon tax goes up every year maybe the PFL does the opposite. They said we wouldn't lose money, they give and then take it away check your vac accounts.

Guest- Guest

Re: Pension for life new policies are out - check them out!!

Re: Pension for life new policies are out - check them out!!

File a new claim under OA to vac, xrays, MRI see what happens, can aways appeal the original through vrab. It is frustrating, your CM should be able to give you direction thats what they are there for, also call vrab in PEI ask them to copy send you the section on OA they use as reference material to determine OA cases you may get lucky and a secretary will send it, if not google reference material from Canadian university medical professor's on the subject of OA it will be close enough to tell you how they determine their decision and give awards. It is as much about putting together a good case as the injury or ailments themselves when it comes to vrab...Crockett wrote:I've never been so frustrated with a process, it's stressful on so many levels. When I started the process it was for Chronic pain but apparently according to VAC that is not a diagnosis...so a year after my first application was submitted, I was told I had to re-do the medical questionaire stating it was bursitis. I blindly followed their direction and that is on me, however, bursitis falls under OA in policy so I never really questioned it. Had I known this would downgrade my level of award I would have went with OA in the first place. I didn't even have a CM until last August, so I had no one to ask at the time for more clarification. I'm sure most on here know the frustration of asking a question to VAC and receiving a standard response as a reply. Now I'm worried that this will interfere with my DEC decision because in their mind why couldn't someone work with only a 13% disability(hips and knee). So just like last year I have to figure out how to live off a LS and then pray that I am granted another favorable decision.

Guest- Guest

Page 1 of 9 • 1, 2, 3, 4, 5, 6, 7, 8, 9

Similar topics

Similar topics» Question - My PTSD Status Changed to “Complete”?

» Pension For Life Estimated Amounts

» Pension for Life reply from VAC

» New Pension for Life Delay

» MILITARY PENSION FOR LIFE

» Pension For Life Estimated Amounts

» Pension for Life reply from VAC

» New Pension for Life Delay

» MILITARY PENSION FOR LIFE

Page 1 of 9

Permissions in this forum:

You cannot reply to topics in this forum

Home

Home Latest images

Latest images